In the mid-19th century, the Ottoman Empire found itself in a precarious financial situation, trailing behind European technological advancements and struggling to maintain necessary military strength. Despite the global upsurge in trade and capital flows associated with the early wave of globalization, the Ottoman Empire struggled to keep pace, necessitating urgent economic and financial reforms.

In the mid-19th century, the Ottoman Empire found itself in a precarious financial situation, trailing behind European technological advancements and struggling to maintain necessary military strength. Despite the global upsurge in trade and capital flows associated with the early wave of globalization, the Ottoman Empire struggled to keep pace, necessitating urgent economic and financial reforms.

The roots of reform in the Ottoman Empire trace back to the 18th century. However, it was with the proclamation of the Tanzimat Decree, heralding the establishment of a constitutional state in the Empire, that the reform movement entered a new phase. During this period, the influence of European liberalism, which had burgeoned on the continent, began to permeate the Ottoman Empire. While the Tanzimat era witnessed European impact on administrative, military, and economic domains, the latter domain lagged behind the broader momentum of change.

The imperative for financial sustenance underscored the need for funding the reforms. Simultaneously, the value of Ottoman currency experienced a precipitous decline. When Sultan Mahmut II assumed the throne in 1808, the exchange rate stood at 19 piasters to one Pound Sterling; however, by his demise in 1839, this ratio had surged to 106 piasters per Pound Sterling. Foreign borrowing remained inconceivable to the Empire's governing authorities, as it was perceived as tantamount to surrendering sovereignty. Consequently, the sole recourse to generate new resources involved emulating a European practice – the issuance of paper money.

Printing Paper Money

In 1840, the inaugural issuance of paper currency, known as kaime, transpired, marking a pivotal moment in financial history. Distinguished by an interest rate of 12.5 percent, this monetary instrument assumed characteristics akin to a bond rather than a conventional banknote. Designated to remain in circulation for a span of eight years, the populace encountered challenges in adapting to this unprecedented fiscal innovation. Consequently, the market valuation of the kaime precipitously depreciated, plummeting to 30-40 percent below its nominal worth.

The doubt surrounding the use of paper currency can be clarified by illustrating a subtle distinction when compared to Western practices. In Western economies, banknotes were exclusively disseminated by robust financial institutions duly authorized by the government. The circulating banknotes derived their credibility from the unequivocal guarantees proffered by these esteemed banks. Moreover, the coexistence of alternative monetary instruments cultivated a collective trust in the inherent value of paper currency. Conversely, within the Ottoman context, monetary value derived principally from the intrinsic worth of gold and silver, relegating the significance of imperial insignia to a secondary consideration.

Furthermore, in the socio-political context of the Ottoman Empire, marked by a lack of protection for individual rights and freedoms, raising questions about the safety of life and property made instilling trust in paper currency a challenging endeavour. The prevailing sentiment dictated an entrenched reliance on tangible commodities, particularly gold and silver, as the bedrock of financial security, overshadowing the symbolic representation embodied by imperial insignia on banknotes. Thus, the inherent difficulties in establishing a sense of security with paper money within a climate of prevailing uncertainty underscored the formidable challenges faced by the Ottoman populace during this transformative period.

In 1844, the introduction of a bi-metallic standard succeeded the use of paper currency, marking a pivotal moment in financial practices. The subsequent establishment of Banque de Constantinople in 1845 served as a regulatory agency for foreign currency. Regrettably, these early initiatives proved ineffective primarily because they remained largely confined to partial measures, often conflicting with one another.

The unbridled issuance of paper currency resulted in a calamitous depreciation of the kaime, exacerbating the prevailing monetary disorder. The 1844 monetary reform, although implemented with the intent to eliminate altered currency from circulation, faltered in achieving its objective. Furthermore, the Banque de Constantinople succumbed to insolvency, compelled by governmental demands for cash advances. The bank's inadequate capital foundation and limited local resources rendered it incapable of meeting these financial obligations.

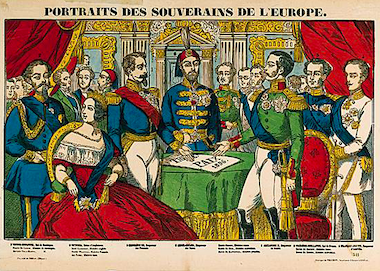

The Crimean War of 1854-56 emerged as a pivotal juncture in the Empire's history, as Ottomans allied with two prominent European powers, Britain and France, in opposition to Imperial Russia. The war concluded with the signing of the Paris Peace Treaty in 1856, a mere month after Sultan Abdülmecit issued the Islahat Decree. This decree, notable for introducing a range of reforms, included financial modifications underwritten by European support.

Foreign Borrowing

The Crimean War signified the initiation of a phase wherein the Ottoman Empire turned to foreign borrowing to address its swiftly expanding deficits. In addition to recurrently issuing new series of paper money, the Sublime Porte embarked on its inaugural foreign loan in 1854—a £3 million loan, issued at an 80 percent rate with a 6 percent interest. Although endorsed but not guaranteed by the British, this marked the commencement of a sequence of loans procured from European markets. Subsequently, in 1855, a £5 million loan followed at 102.6 percent, accompanied by a 4 percent interest, with the backing of the British and French governments. These wartime loans, reflective of allied support, yielded favourable conditions. Money was coming in at a much lower cost than when lent by local bankers, offering a compelling rationale to anchor the Empire's future on the enticing prospect of successive loans. Furthermore, for a government committed to a progressive integration with the West, such financial operations purportedly acted as the cement for future collaboration.

Concerns about the stability of the loans arose within the British and French governments. In these nascent stages, doubts about the Ottoman Empire's ability to fulfil obligations were minimal. To mitigate risk, lenders secured the loans against the prime revenues of the Ottoman state. A commission established in 1855 oversaw expenditures and audited Treasury accounts. The Empire's descent into a debt spiral during this period was attributed to inefficient spending on imprudent projects, including the construction of new palaces along the Bosphorus.

In 1858, a third loan of £5 million transpired at a 76 percent rate and a 6 percent interest. Unlike its predecessors, this loan lacked the backing or guarantee of Western governments. Intended for redeeming paper money, it failed to be utilised for this crucial purpose. Concurrently, various foreign initiatives to exert control over Ottoman finances faltered, dissuading European investors. Despite the Empire's urgent need for funds, its creditworthiness dwindled, leading to a severe financial crisis.

Sultan Abdülmecit died in 1861 and was succeeded by Sultan Abdülaziz. The next year, Grand Vizier Fuat Paşa presented a formal budget, buoyed by a favourable British commission report on the Empire's financial situation. This positive turn facilitated the successful organisation of an £8 million loan at a 68 percent rate and 6 percent interest. Aimed at definitively redeeming circulating paper money, this loan restored confidence in the market. Facilitating this operation were Deveaux and Co. from London and the Ottoman Bank—a London-based commercial bank established in 1856, which had gained credibility in the Ottoman market over time. The Sublime Porte selected this bank to organise the 1862 loan, stipulating the inclusion of French capital to mitigate the risk of sole British dominance. The prospect of having a foreign state bank was worrying enough, but practically unavoidable; however, dividing its capital between the French and the British was likely to minimize the risk of being completely ruled by the British alone.

Imperial Ottoman Bank

In 1863, the Ottoman Bank underwent a significant transformation, assuming the role of a state bank and adopting the title Banque Impériale Ottomane (Banka-i Şahane-i Osmani). Although bestowed with the authority to issue banknotes, it lacked influence in the Empire's financial decision-making processes. Despite falling short of constituting a mechanism for controlling state finances, the mere presence of the Banque Impériale Ottomane instilled a semblance of security, albeit disappointing foreign investors.

Two loans, amounting to £8 million in 1863 and £6 million in 1865, were orchestrated by the Banque Impériale Ottomane at interest rates of 71 and 66 percent, respectively. Simultaneously, extant paper currency was withdrawn from circulation. Consequently, the Ottoman government found itself ensnared in a deleterious cycle of debt. The funds procured from these loans were allocated to settling outstanding foreign and domestic debts.

Beyond foreign loans, the state heavily engaged in short-term borrowing from local bankers, perpetuating an undesirable financial status quo. The presence of the Banque Impériale Ottomane, while failing to prompt rectification, dissuaded foreign investors from relinquishing their profitable engagement.

Between 1865 and 1870, foreign borrowing persisted, resulting in a government debt escalation to £86 million—2.3 times the cumulative borrowed sum over the preceding eleven years. Nonetheless, due to limited issuance rates, only half of this nominal value reached the Treasury, predominantly serving to retire antecedent debts. In the subsequent period from 1871 to 1874, five additional loans were contracted, accumulating to £98.5 million. Notably, by this juncture, 55 percent of the Empire's budget was absorbed by foreign debt.

In a concerted effort to enhance Western confidence in Ottoman bonds, the Sublime Porte took a significant step in May 1874 by formalizing a comprehensive agreement with the Banque Impériale Ottomane. This strategic move aimed to bolster the institution's influence in overseeing both revenues and expenditures. Under more rigorous conditions, the Ottoman government endeavored to rebuild trust in its bonds within Western financial circles.

Following the establishment of this pivotal agreement, the Banque Impériale Ottomane successfully negotiated a substantial £40 million loan. This financial arrangement was particularly notable for the marked reduction in the interest rate, which plummeted to a mere 40 percent. The meticulous execution of this transaction demonstrated the commitment of the Ottoman government to navigating more stringent conditions and, concurrently, showcased the proactive measures taken to restore Western confidence in Ottoman financial instruments.

Ottoman finances going bankrupt

The 1875 agreement, however, proved futile, given the Ottoman finances' insolvency. On 6 October 1875, Grand Vizier Mahmut Nedim Paşa decreed a 50 percent reduction in coupon payments. By March 1876, payments ceased as Balkan troubles led to Sultan Abdülaziz's deposition and Serbia's declaration of war. The bankrupt Empire plunged European investors into panic.

The political scenario rapidly worsened. Sultan Murad V, Abdülaziz's mentally unstable successor, was promptly removed, succeeded by Sultan Abdülhamit II. War with Serbia and the looming Russian threat escalated to full-scale conflict in April 1877. The Turco-Russian war culminated in January 1878, diminishing the Ottoman Empire to a minor player in European politics via the Congress of Berlin.

Already financially strained, the Ottoman Empire faced increased pressure from the war with Russia. Unable to secure foreign loans, the government resorted to printing paper money, resulting in a 65 percent depreciation over three issues within two years, totaling 1.8 billion piastres. By 1880, the paper money had plummeted to 10-15 percent of its original value.

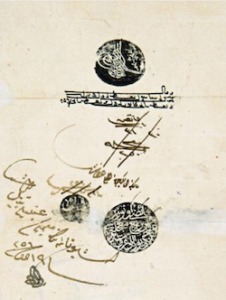

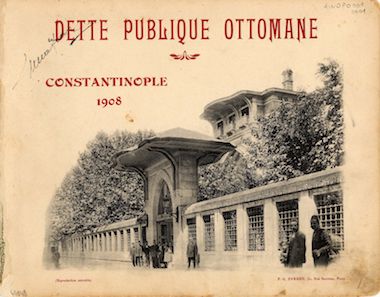

The Sublime Porte urgently sought resolution for outstanding debts. A November 1879 agreement with local creditors, surrendering some indirect revenues, partially addressed internal debts. Encouraged by this success, similar negotiations commenced with foreign lenders. The outcome, the Muharrem Decree signed on 20 December 1881, established the Ottoman Public Debt Administration (Düyun-u Umumiye). This organization, comprising European bondholders, indirectly connected with major European powers (except Russia), gained the right to develop and collect taxes from key revenue sources. Until the debt's liquidation, the Muharrem Decree irrevocably assigned to the Ottoman Public Debt Administration revenues from stamp, spirits, fishing taxes, silk tithe, salt and tobacco monopolies, Bulgaria tribute, Cyprus surplus, and Eastern Rumelia revenues.

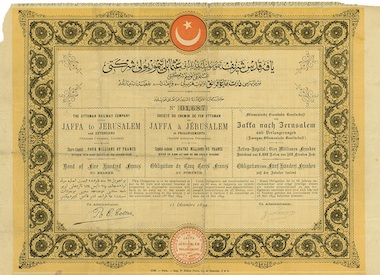

The establishment of the Ottoman Public Debt Administration, despite encroaching upon the sovereignty of the Empire by relinquishing fiscal rights and submitting to foreign control, yielded success by restoring Ottoman creditworthiness. Between 1886 and 1914, the government secured an additional 23 loans, amounting to £150 million, with an average issuance rate exceeding 85 percent.

The council, with governmental approval, could enact measures enhancing broader economic conditions, as a more prosperous Turkey implied augmented revenue collections. This initiative fostered salt exports, implemented advanced technologies in silk and wine industries, and facilitated railway development within the Empire. Subsequently, foreign capital inundated the Ottoman market, progressively assuming control of pivotal economic sectors. Ottoman integration with Europe from the 1890s onwards started to take a substantially different course, resembling a trajectory akin to imperialism.

Despite the Ottoman state achieving a budget surplus and systematically settling outstanding debts during the latter two decades of the 19th century, escalating military expenditures, notably post-1908, rekindled formidable challenges. Deficits resurfaced, necessitating further borrowing. By 1914, the government's outstanding debt stood at £140 million, approximately 60 percent of the Ottoman gross domestic product, on top of which came the burden of the First World War.

![]()

Sources consulted:

- Akyıldız, A., “Para Pul Oldu: Osmanlı’da Kağıt Para, Maliye ve Toplum” (Paper Money, Public Finance and Society in the Ottomans), İletişim Yayınları, Istanbul, 2003.

- Eldem, E., "A History of the Ottoman Bank", Ottoman Bank Historical Research Cente, Istanbul, 1999.

- Elmacı, M.E., “İttihat Terakki ve Kapitülasyonlar” (Committee of Union and Progress and the Capitulations), Homer Kitabevi, Istanbul, 2005.

- Esin, T., "Osmanlı Savaşı'nın İktisadî Aktörleri 1914-19" (The Economic Actors of the Ottoman War 1914-19), Tarih Vakfı Yurt Yayınları, Istanbul, 2020.

- Geyikdağı, V.N., “Osmanlı Devleti’nde Yabancı Sermaye 1854-1914” (Foreign Investment in the Ottoman Empire 1854-1914), Hil Yayın, Istanbul, 2008.

- Issawi, C., "The Economic History of Turkey, 1800-1914", University of Chicago Press, Chicago, 1980.

- Pamuk, Ş., “Osmanlı Ekonomisinde Bağımlılık ve Büyüme 1820-1913” (Dependence and Growth of the Ottoman Economy 1820-1913), Tarih Vakfı Yurt Yayınları, Istanbul, 1994 (first published in Ankara, 1984)

- Toprak, Z., “İttihad-Terakki ve Cihan Harbi: Savaş Ekonomisi ve Türkiye’de Devletçilik 1914-1918” (Committee of Union and Progress and the World War: War Economy and Etatism in Turkey 1914-1918), Homer Kitabevi, Istanbul, 2003.

- Yorulmaz, N., “Büyük Savaşın Kara Kutusu: 2. Abdülhamid’den 1. Dünya Savaşı’na Osmanlı Silah Pazarının Perde Arkası” (The Black Box of the Great War: Behind the Scenes of the Ottoman Arms Market from Abdulhamid to the First World War), Kronik Kitap, Istanbul, 2018.

PAGE LAST UPDATED ON 30 DECEMBER 2023